nj tax sale certificate premium

Taxations Audit branch to administer the Liquor License Clearance program. Taxations Field Investigations Unit.

Recessionopoly Another Design From Threadless Tees Found On Cakewrecks Com Nostalgia Art Threadless Tees Reflective Journal

Completed New Jersey Resale Certificate Form ST-3 or Streamlined Sales and Use Tax Agreement Certificate of Exemption Form ST-SST.

. Fill out the ST-3 resale certificate form. If the tax sale certificate is not redeemed or the. Ad Download Or Email NJ ST-3 More Fillable Forms Register and Subscribe Now.

This post discusses only those tax sale foreclosures completed by individual non-municipal TSC holders. Electronic Municipal Tax Sales Online LFN 2018-08 Adoption of NJAC 533-11 creating regulations for long standing PILOT program for internet-based tax sales. If you are served with a foreclosure complaint or wish to pursue a claim on a tax sale certificate please call us at 973 890-0004 or e-mail us to see how we can assist you.

After July 1 2017 any applicant for certification that cant obtain a Premier Business Services account may submit a paper application Gtb-10 for business. New Jersey Tax Lien Auctions. A day or two before the sale at the latest you must submit a deposit of at least 10 percent of the amount you plan to bid at the tax sale.

List of installments not due. Here is a summary of information for tax sales in New Jersey. 545-1 to -137 a purchaser of a tax sale certificate acquires a tax lien not a lien securing the property owners obligation to pay the amount owing to redeem the certificate.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Therefore you can complete the ST-3 resale certificate form by providing your New Jersey Sales Tax Permit Number Taxpayer Registration Number. If you bid premium and most liens in New Jersey are won at high premiums you dont get any interest on the certificate amount however you do get interest on the subsequent tax payments.

Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. Contracts considered professional service. In order to redeem the lien the property owner must pay the certificate amount plus the redemption penalty and the subsequent tax amount at 24.

Municipal charges include but are not limited to. February 1 May 1 August 1 and November 1. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA.

Complete a New Jersey Sales and Use Tax Registration. Interest on subs is 8 per annum until 1500 is owed then its 18. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is.

If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate. At a tax sale title to the delinquent property itself is not sold. The New Jersey Supreme Court in In re.

Installments not yet due may be excluded. Once a tax clearance is approved we send the certificate electronically to the municipal clerk where the license is located. Certifiedutility amounts calculated to DATE OF SALE 2 Cost of Sale min of 1500 Max of 100 In Lieu of Mailing Fee if authorized by resolution of Governing.

The attorneys at McLaughlin Nardi are well versed in tax sale certificate and tax sale foreclosure law. As with any governmental activity involving property rights the process is not simple. The premium is kept on deposit with the municipality for up to five years.

Instead the winner of the Tax Sale Certificate now has a lien against the property in the amount paid for the Tax Sale Certificate plus interest and penalties which will continue to accrue. This legislation establishes requirements for publication of notice issuance of notice to the property owner bidder registration conducting the online tax lien sale as. In New Jersey property taxes are a continuous lien on the real estate in the full annual amount as of the 1stof the year.

State Alcohol Beverage Commission. The municipality has to give you back your premium of 1000000. The ClearanceLicense Verification Unit works with the.

Property taxes are payable in four installments. New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. We have 566 municipalities each of which has its own tax sale.

Tax Sale Certificate Basics All owners of real property are required to pay both property taxes and any other municipal charges. Discretion of tax collector as to sale. Municipal Charges can include but are not limited to.

New Jersey assesses taxes on the local municipal level. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Thus when you pay your taxes.

To 430 pm Monday through Friday excluding State holidays. If you choose to expedite your application you will receive it in 2 business days. Ignoring the law may cost.

Princeton Office Park LP. As a seller of taxable goods or services you are required to be registered with the New Jersey Division of Revenue and Enterprise Services. Now about 10-20 or so are on line.

Plymouth Park Tax Services LLC determined that under the Tax Sale Law NJSA. Interest rates at the auctions start at 24 and can eventually be bid down to zero. Tax sale is the enforcement of collections against a property by placing a lien against the property for all outstanding municipal charges due at the end of the calendar year December 30.

This is your permit to collect Sales Tax and to use Sales Tax exemption certificates. Dates of sales vary depending on the municipality. The holder of a New Jersey Tax Sale Certificate does not own the property.

If the tax sale certificate is not redeemed or the property foreclosed upon within the five year period then the premium escheats to the municipality. Bidding stops to obtain the tax sale certificate. Lands listed for sale.

Once you have that you are eligible to issue a resale certificate. Ad Instantly apply and receive the proper tax resale certificate your business. Thats 5000 lien amount 200 4 redemption penalty 1000000 subsequent taxes 240000 24 of subs 17600.

1 Property Taxes 2 Sewer Charges 3 Special Assessment Charges 4. 18 or more depending on penalties. Statement in certificate of sale.

State of New Jersey Division of Taxation SALES TAX FORM ST-3 RESALE CERTIFICATE Purchasers New Jersey Taxpayer Registration Number To be completed by purchaser and given to and retained. What is the risk of purchasing a Tax Sale Certificate in New Jersey. What is sold is a tax sale certificate a lien on the property for delinquent outstanding municipal charges due.

The Plaintiff in a tax sale foreclosure must at least 30 days prior to filing its complaint give written notice of its intention to foreclose as well as the amount necessary to redeem. New Jersey is a good state for tax lien certificate sales. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

If you invest in tax sale certificates be mindful of the complexities of the governing state law when you file a bankruptcy proof of claim on account of the certificate. Purchasers of tax sale certificates in New Jersey buy at their own risk. Complete Edit or Print Tax Forms Instantly.

Pay your initial deposit. A tax sale is the sale of tax liens for delinquent municipal charges on a property. Most auctions are in person call out.

Added omitted assessments. Since the price of the properties is already fixed simply mark the properties you plan to bid on and deposit 10 percent of the total. The description below is designed to provide the reader with a brief overview of this procedure.

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

Certificate Of Incorporation Free Printable Certificates Printable Certificates Best Templates

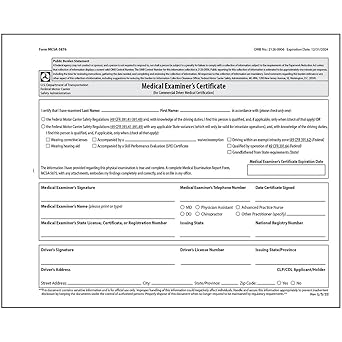

Amazon Com Dot Fmcsa Medical Examiner Certificate 10 Pk 2 Ply 4 25 X 5 25 Commercial Driver Medical Certification To Comply With 49 Cfr 391 43 Dot Medical Card Requirements Office Products

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Sea Home Decor Printable Black And White Ocean Photography Print Wall Art Poster Gift For Her Printable Wall Poster Wall Art Wall Art Prints Printable Wall Art

Employee Information Form Template Best Of 47 Printable Employee Information Forms Personnel Employment Form Payroll Template Employee Tax Forms

The Essential List Of Tax Lien Certificate States

Amazon Com Dot Fmcsa Medical Examiner Certificate 10 Pk 2 Ply 4 25 X 5 25 Commercial Driver Medical Certification To Comply With 49 Cfr 391 43 Dot Medical Card Requirements Office Products

5 Documents To Verify When Buying A Ready Possession Flat Home First Time Home Buyers How To Plan Home Buying

Amazon Com Dot Fmcsa Medical Examiner Certificate 15 Pk 2 Ply 4 25 X 5 25 Commercial Driver Medical Certification To Comply With 49 Cfr 391 43 Dot Medical Card Requirements J J Keller Associates Office Products

Image Result For Nonprofit Donation Letter For Tax Receipt Donation Letter Template Donation Thank You Letter Donation Letter